The 9-Minute Rule for Dental Debt Collection

Wiki Article

The Only Guide to Business Debt Collection

Table of ContentsThe Only Guide for International Debt CollectionThe Single Strategy To Use For Debt Collection AgencyGetting My Dental Debt Collection To WorkBusiness Debt Collection for Dummies

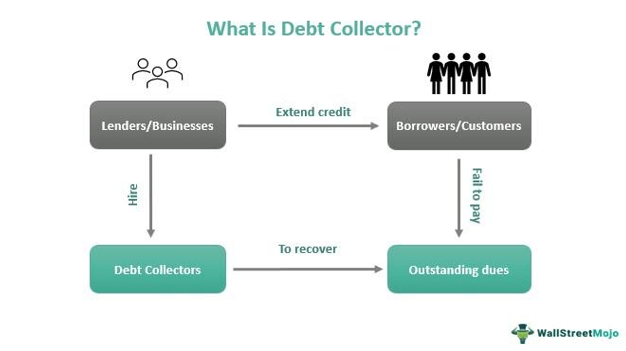

A financial debt collector is an individual or company that is in the organization of recuperating cash owed on delinquent accounts - Dental Debt Collection. Numerous financial debt enthusiasts are employed by business to which cash is owed by individuals, operating for a level cost or for a portion of the quantity they have the ability to collectA financial obligation enthusiast attempts to recover past-due financial obligations owed to lenders. Some financial obligation collectors purchase delinquent financial obligations from lenders at a discount rate as well as after that seek to gather on their own.

Financial debt collection agencies that go against the guidelines can be filed a claim against. When a customer defaults on a financial obligation (definition that they have actually fallen short to make one or even more necessary repayments), the loan provider or lender may turn their account over to a financial obligation collector or debt collectors. Then the debt is claimed to have actually mosted likely to collections.

Some companies have their own financial debt collection departments. The majority of locate it much easier to hire a financial obligation enthusiast to go after unpaid debts than to chase after the clients themselves.

Business Debt Collection - An Overview

Debt collectors may call the person's individual as well as work phones, and also even show up on their front door. They may additionally call their household, friends, and next-door neighbors in order to validate the call details that they have on documents for the individual.m. or after 9 p. m. Neither can they incorrectly assert that a debtor will certainly be jailed if they fall short to pay. Furthermore, an enthusiast can't literally damage or threaten a debtor and also isn't permitted to confiscate possessions without the approval of a court. The legislation likewise offers borrowers particular legal rights.

Both can remain on credit score records for up to 7 years and also have a negative impact on the individual's credit rating, a large section of which is based on their settlement background. No, the Fair Debt Collection Practices Act applies only to consumer financial debts, such as mortgages, bank card, auto loan, student next page fundings, as well as medical bills.

The 4-Minute Rule for International Debt Collection

Because frauds are common, taxpayers ought to be careful of anyone purporting to be working on behalf of the IRS as well as inspect with the IRS to make sure. Some states have licensing demands for debt collection agencies, while others do not.

A debt collection firm is a firm that acts as middlemen, accumulating customers' overdue debtsdebts that are at least 60 days previous dueand paying them to the original financial institution. Learn extra about exactly how debt collection agenies as well as financial debt collection agencies function. Dental Debt Collection.

Financial debt collectors make money when they recoup overdue debt. Some debt collector discuss negotiations with customers for less than the amount owed. Added government, state, and regional regulations were implemented in 2020 to secure customers confronted with debt issues associated to the pandemic. Financial debt debt collection agency will pursue any type of overdue financial obligation, from past due pupil financings to unpaid medical bills.

Getting My Personal Debt Collection To Work

An agency could gather only overdue debts of at the very least $200 and also less than two years old. A credible company will certainly also restrict its job to gathering financial debts within the law of limitations, which differs by state. Being within the statute of constraints indicates that the financial obligation is not as well old, as well as the creditor can still pursue it legally.A debt enthusiast needs to count click over here on the borrower to pay as well as can not confiscate a paycheck or reach into a financial institution account, even if the directing as well as account numbers are knownunless a judgment is acquired. This suggests Business Debt Collection the court orders a debtor to pay back a specific total up to a particular lender.

This judgment allows an enthusiast to start garnishing earnings and financial institution accounts, however the collector has to still speak to the debtor's employer and also financial institution to request the cash. Financial debt enthusiasts additionally call delinquent borrowers that already have judgments against them. Also when a creditor wins a judgment, it can be testing to accumulate the cash.

When the original financial institution figures out that it is unlikely to gather, it will reduce its losses by selling that debt to a financial debt buyer. Financial institutions bundle various accounts along with comparable features as well as sell them as a team. Financial debt purchasers can pick from bundles that: Are reasonably new, with no various other third-party collection activity, Older accounts that other enthusiasts have failed to accumulate on, Accounts that fall someplace in between Financial debt purchasers typically buy these bundles with a bidding process, paying on typical 4 cents for every $1 of financial obligation stated value.

Report this wiki page